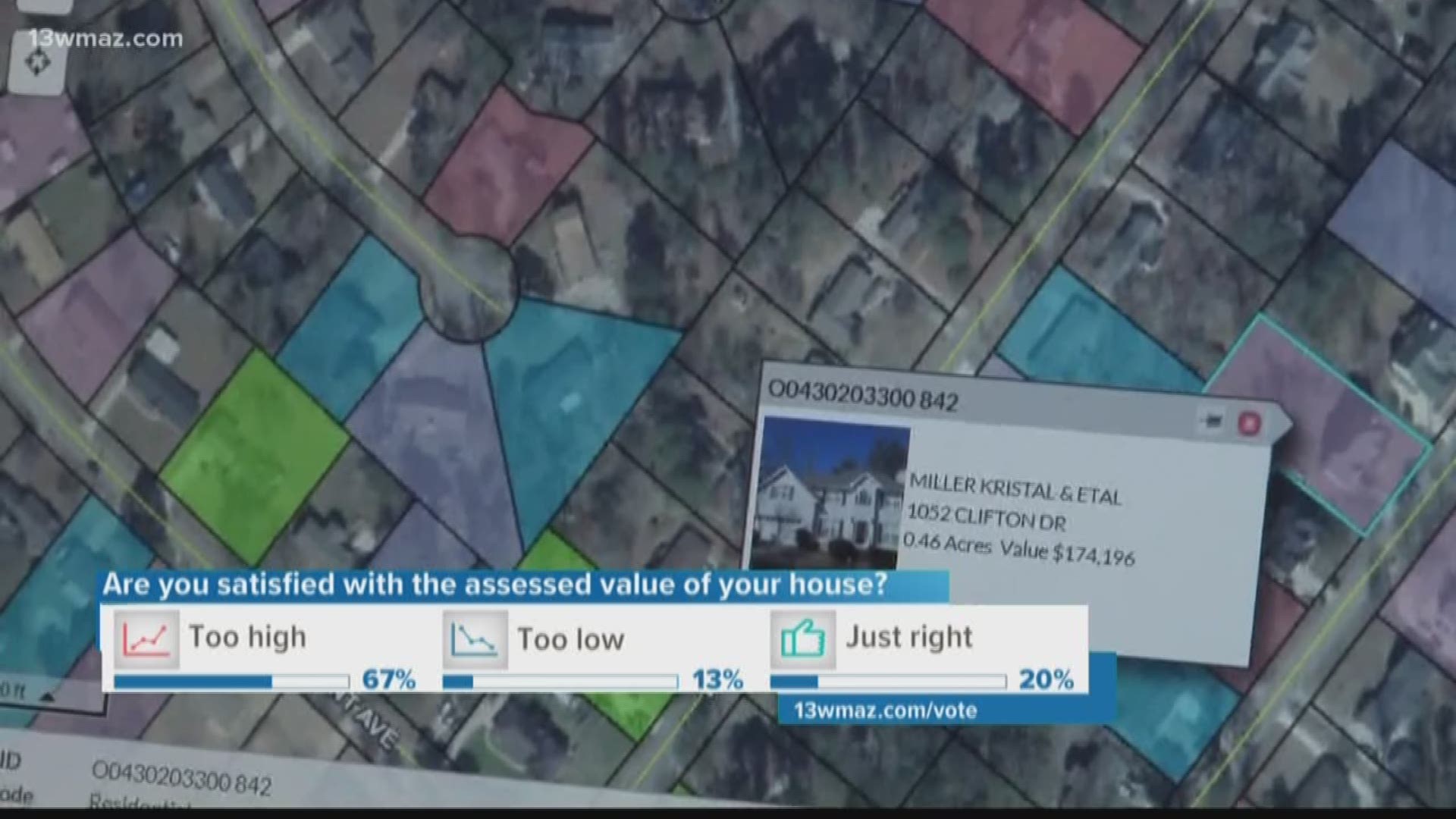

People living in Macon saying they’re receiving notices from the tax assessors office that says their homes have increased in value, even if they haven't done anything to their home in decades.

Appraiser Tom Wilson says Lake Wildwood is one neighborhood where property values continue to grow.

"If you go to the bank, the high appraisal is always the right one, and if you go to the tax appraiser's office, is the low one is always the right one," said Wilson.

He says now is the time he gets lots of phone calls since the county’s tax assessors office sent out their property values for 2019.

Andrea Crutchfield, the chief tax assessor for Bibb County, says there are certain things you should look at on your property value notice.

"The current fair market value is important to look at, and it has the prior year on here as well, and of course, there’s an estimate of taxes which are based on last year's millage rate," said Crutchfield.

She says the county’s property values are up 2 percent overall.

"People could continue to think that’s this is an increase in revenue. That’s not the case if there’s an increase in the tax digest the commissioners would need to roll back the millage rate," said Crutchfield.

She says a third of homeowners will see their appraisals go up or down, but you have the chance to appeal.

"If you think you’re overtaxed, you can appeal that and there’s a process to do that, and If you’re going in, you have to make sure you have your ducks in a row," said Wilson.

Wilson says the tax assessors office does “drive-by appraisals,” so they don’t look inside of your home like he does.

Crutchfield says that about 109 neighborhoods saw property value increases this year.

If you'd like to file an appeal, the last day is June 24th.

Those neighborhoods that saw the property value increases are not in one area, they are all over the county.

Andrea Crutchfield says property values have increased about 2 percent overall throughout the county.

The county sent about 65,000 notices this year, and the values for about 1 out of 10 properties increased.

About 2 out of ten decreased.

Wilson says sometimes, the tax assessors office gets the property value wrong because they only look at the outside of your home, not inside.

He says if you want to file an appeal, you should look up the homes that have sold in your neighborhood as a comparison.

Crutchfield says that 109 neighborhoods out of nearly a thousand saw those property tax increases this year. She says they're all over the county, not centered in just one area.