The 3-mill tax increase Bibb commissioners approved last week has lots of people talking and has some neighbors taking shots.

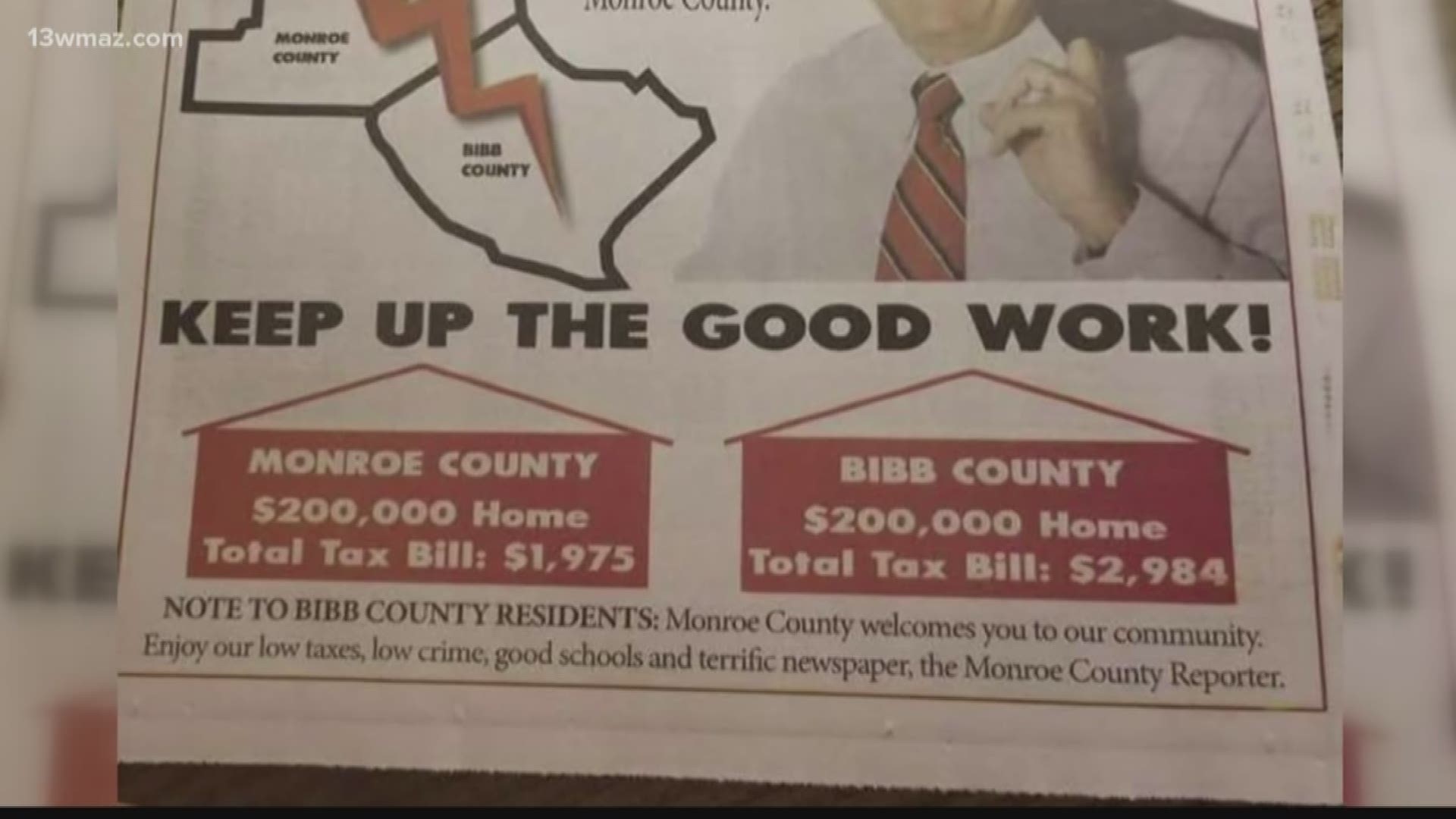

An advertisement in the latest edition of the weekly Monroe County Reporter states the owner of a $200,000 home on the Bibb County would pay almost $1,000 more in property taxes each year than someone who owned a similar home in Monroe County.

We wanted to verify if that number was correct.

Our sources are tax commissioners Wade McCord for Bibb County and Lori Andrews for Monroe County.

Louis Bickett says lives in Monroe County and says his home is worth around $170,000. He's lived there for over 30 years and doesn't want to leave.

“A lot of people say you need to move to Florida, but they have too many alligators in Florida so I’d like to stay where I’m at,” said Bickett.

On the other hand, Russell Sheppard lives in an almost $200,000 home in Bibb County. He wants to move.

“I want to sell this property just as quick as I can because they raised taxes the way they did,” said Sheppard.

What is the difference between Bickett and Sheppard's taxes?

Well, if you own a $200,000 home in Bibb County and have homestead exemption, your tax bill would be $2,917.52.

If you owned the same home in the city of Forsyth, your real-estate tax bill would be $2,216 with a homestead exemption. In the rest of the county, you'd pay $1,976 -- that's about $940 less than in Bibb.

“I don’t have any issues with the county, I really don’t,” said Bickett.

“To me it's not worth it,” said Sheppard.

We verified that the Bibb County homeowner would pay several hundred dollars more than in Monroe County, but in most of the county the difference is just short of $1,000.

But is that enough to move people out of Bibb to Monroe? That's just a guess by the Reporter’s publisher Will Davis.