MACON, Ga. — As you head to the polls, you may be most prepared to make your pick for President, Sheriff, or House Representative. However, there are a few more selections to make.

You will see three yes or no questions - all tax related - on your ballot. Two are related to exemptions, and one calls for creating a statewide tax court.

The first question you'll see is known as Amendment One.

Homestead Exemption

Homestead exemptions are the local tax break on people's primary residence. This amendment would mostly target counties that don't already offer homestead exemptions. It would create uniformity throughout the state.

Usually, property taxes rise when property values rise. As a homeowner, if you vote yes, that means you support you tax bill not rising by more than the rate of inflation.

Local governments and schools could choose to opt out of this.

According to the Associated Press, your homestead exemption would last as long as you own your home.

Middle Georgia State University Professor of Economics Greg George says there are other things to keep in mind.

"You have to consider that money typically, if it's collected, goes to the school systems. If you feel like the schools are need the funding more, than you might vote against it. If you feel like people need the tax relief more, than you would vote yes for it," George said.

"Those homestead exemptions curtail the collection of property taxes which typically go to local schools. So, you know, people who are more concerned about the schools should take that into consideration," he shared.

State Tax Court

The second question is known as Amendment Two.

It would create a new court system focused solely on tax cases. This system would work alongside County Superior Courts.

If you vote yes, you are showing support for the creation of the court.

Supporters say this could free up Superior Court judges for other responsibilities.

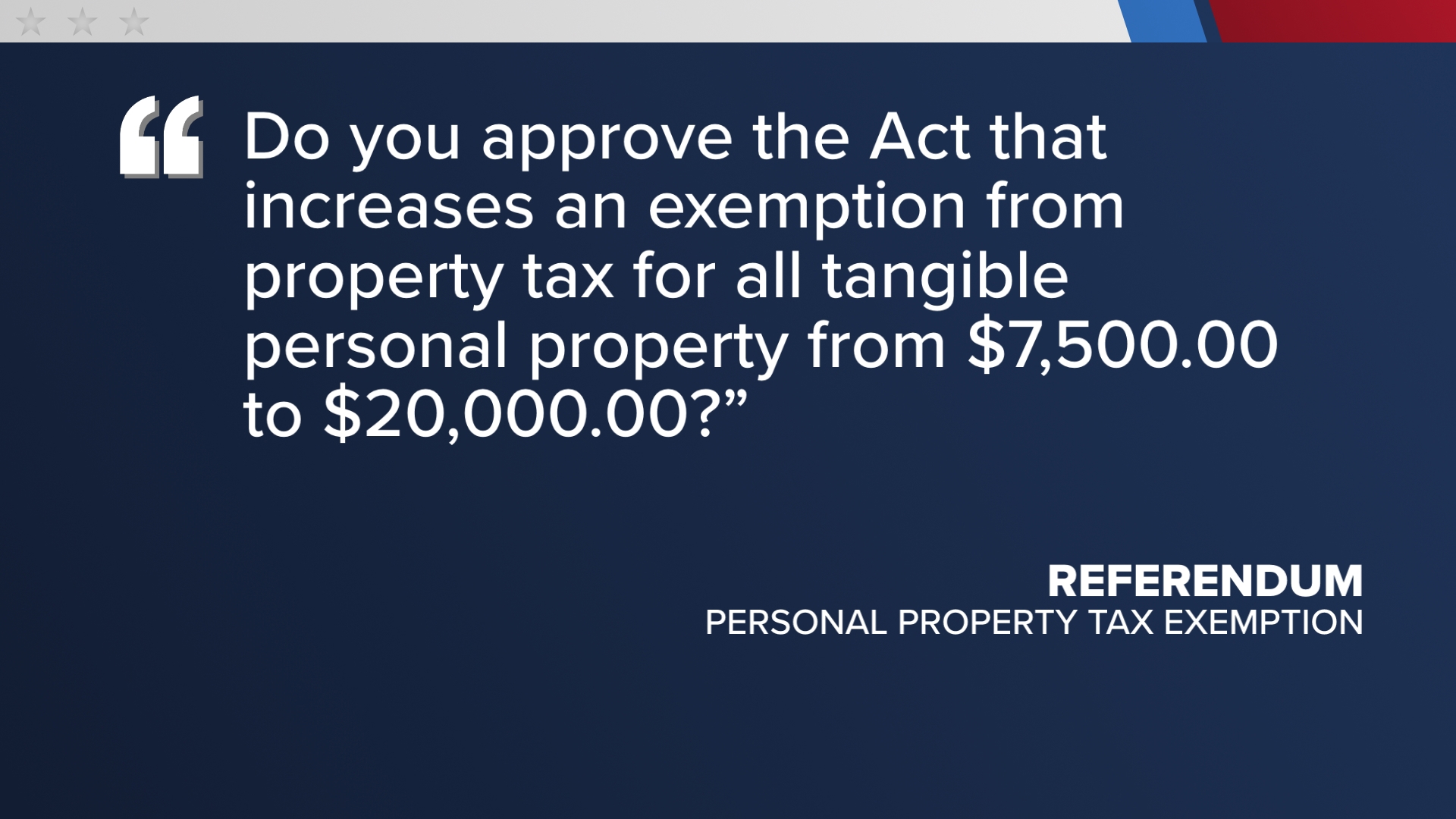

Tangible Personal Property Exemption

The last question is a referendum on personal property taxes.

"That applies to both businesses and things like boats and things like that," George said.

Right now, property worth less than $7,500 is exempt from personal property taxes. This hasn't been updated since the early 2000's. George says this tax exemption hasn't kept up with the impact of inflation.

"Because of inflation, people are looking for more money. Tax cuts are a way to put more money in people's pockets," George said.

If you vote yes, you are voting for increasing the exemption on personal property to $20,000.

According to the Secretary of States office, if a majority of people vote yes, each of these acts take effect on Jan. 1, 2025. Brad Raffensperger with the Secretary of State's office encourages you to go read their summaries of each bill for yourself.

You can find those here.

If you have election questions about the voting process, send us an email at news@13wmaz.com or reach out on social media.