MACON, Ga. — April is here, so it's time to file accurately on or by April 18th to avoid Uncle Sam coming after you.

Whether you're filing jointly, separately, or have a business, you have to account for tax season, especially when April 1st hits can bring on the pressure.

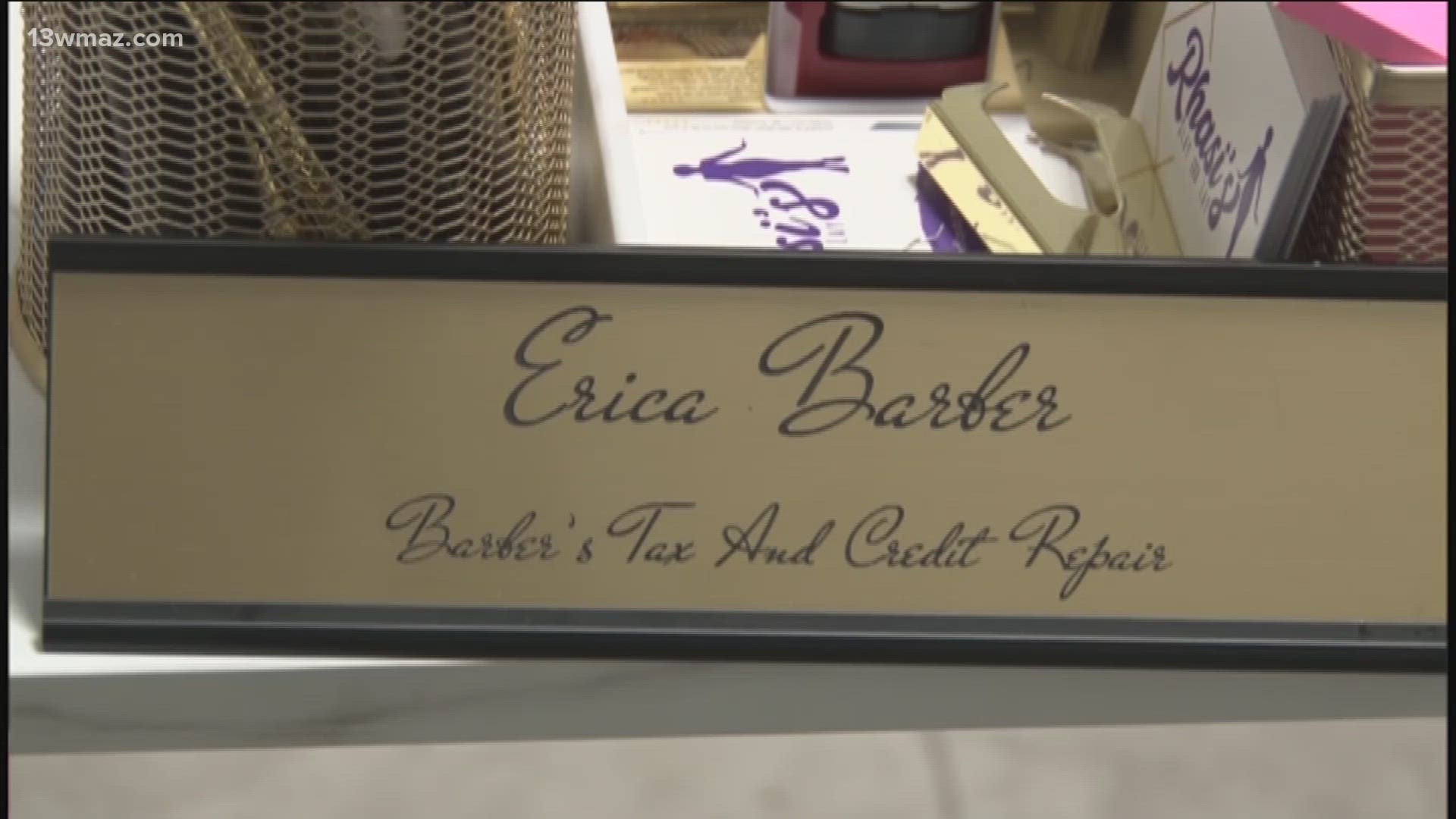

Tax preparer Erica Barber says she sees people filing in December and January.

"It starts slowing down right about March. It gets pretty steady, then another rush in April," says Barber.

She says there's a solution for self-employed people who are worried they didn't keep up with receipts.

"You swiped your card. Your bank statements are your receipts. So go back through your statements for the full year. Those are your receipts to cover any expenses or any income to help you out with your taxes," says Barber.

Barber says she noticed returns are a lot smaller this year. She has seen a difference with the standard deduction too.

"The standard deduction has increased nearly 7% this year. That's great for people with joint households and married couples filing jointly," says Barber.

She wants people to look out for tax preparers that ask for half of your refund.

"As a preparer, we are allowed to take the full amount or at least some of it out and have you pay a small fee out of pocket just so you can pay the bank fees," says Barber.

Ensure all the information is correct and you have receipts to show the IRS.

"One thing I have noticed during this tax season is that the IRS is way more active than they've been in the last few years. Meaning, as soon as I filed a return, they reached out to a client directly saying, hey, we need to see this document," says Barber.

Most tax preparers are year-round, but there are some seasonal ones. If you're stressed out about taxes, remember you can file an extension, then they'll be due in October. Also, there is still time to find a tax prepare just make sure it's someone you trust.