HOUSTON COUNTY, Ga. — The county's estimate of your property's value is an appraisal; that number plays a part in what you pay in property taxes.

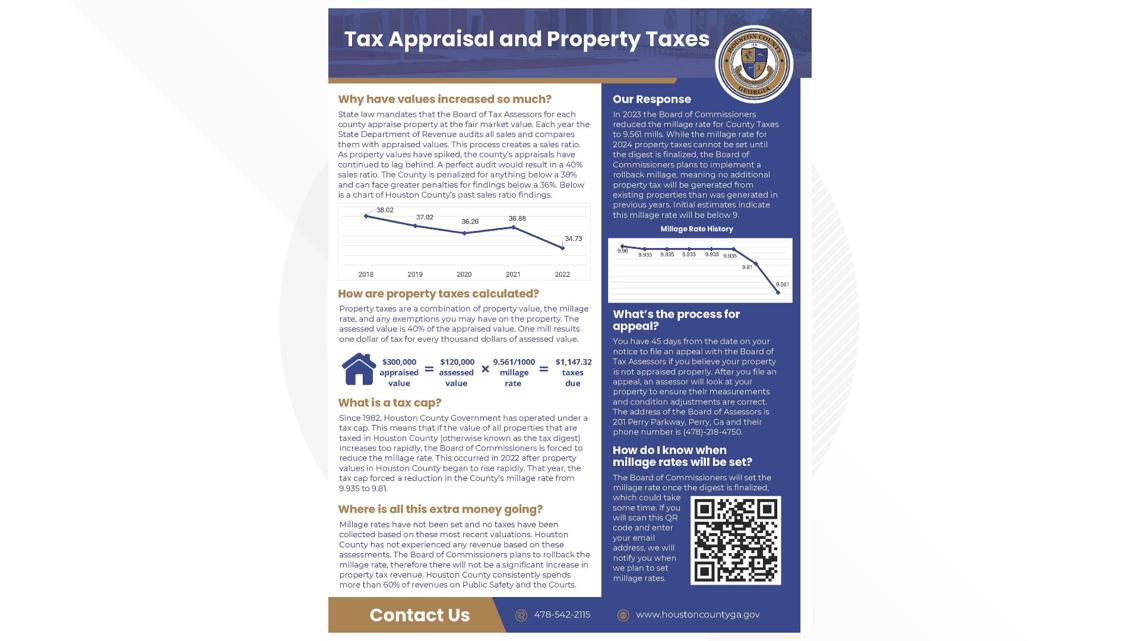

Property taxes are not just about your property's value; they also take into account the millage rate and any potential exemptions on your property.

Some residents in Houston share concerns about the boost in their property value.

"The Houston County Board of Commissioners fully recognizes property values and property appraisals and assessments are rising at a very rapid rate in Houston County," Chairman Dan Perdue said.

"Unfortunately, the Board of Tax Assessors is mandated by state law to appraise things at a fair market value," he continued.

If Houston County's property values don't keep up with sales figures, according to the Georgia Department of Revenue, Perdue explained, the county could face penalties.

"Last year, because our sales ratio number was not between 38 and 42, public utilities, we lost about $600K just in the county; that doesn't include the school boards or the cities," Perdue said.

The county and tax assessor's office want to avoid that, Perdue said.

If you'd like to appeal, the tax assessor's office shared that the deadline to submit an appeal is July 1st. You can go in person to the Board of Tax Assessors office, located at 201 Perry Parkway in Perry. You will need to put something in writing, or you can mail in an appeal.

If you live in the county limits, your first budget hearing is Tuesday. It will be at 9:00 a.m. in the Perry Courthouse on Perry Parkway.