MACON, Ga. — The coronavirus pandemic has caused some of the highest unemployment rates in recent history. Families are struggling and some are turning to online payday lenders for help. The economy is slowly reopening, but that doesn't mean families aren't still struggling financially. Some might think help is just a click away, and you can find payday loan companies online, but beware.

"Even though Google and Facebook blocked these kinds of companies from advertising on these platforms, they're still getting through and people are getting to these loans, and some of them charge 500% interest and they're just a disaster," says Rosenberg Financial advisor Sherri Goss.

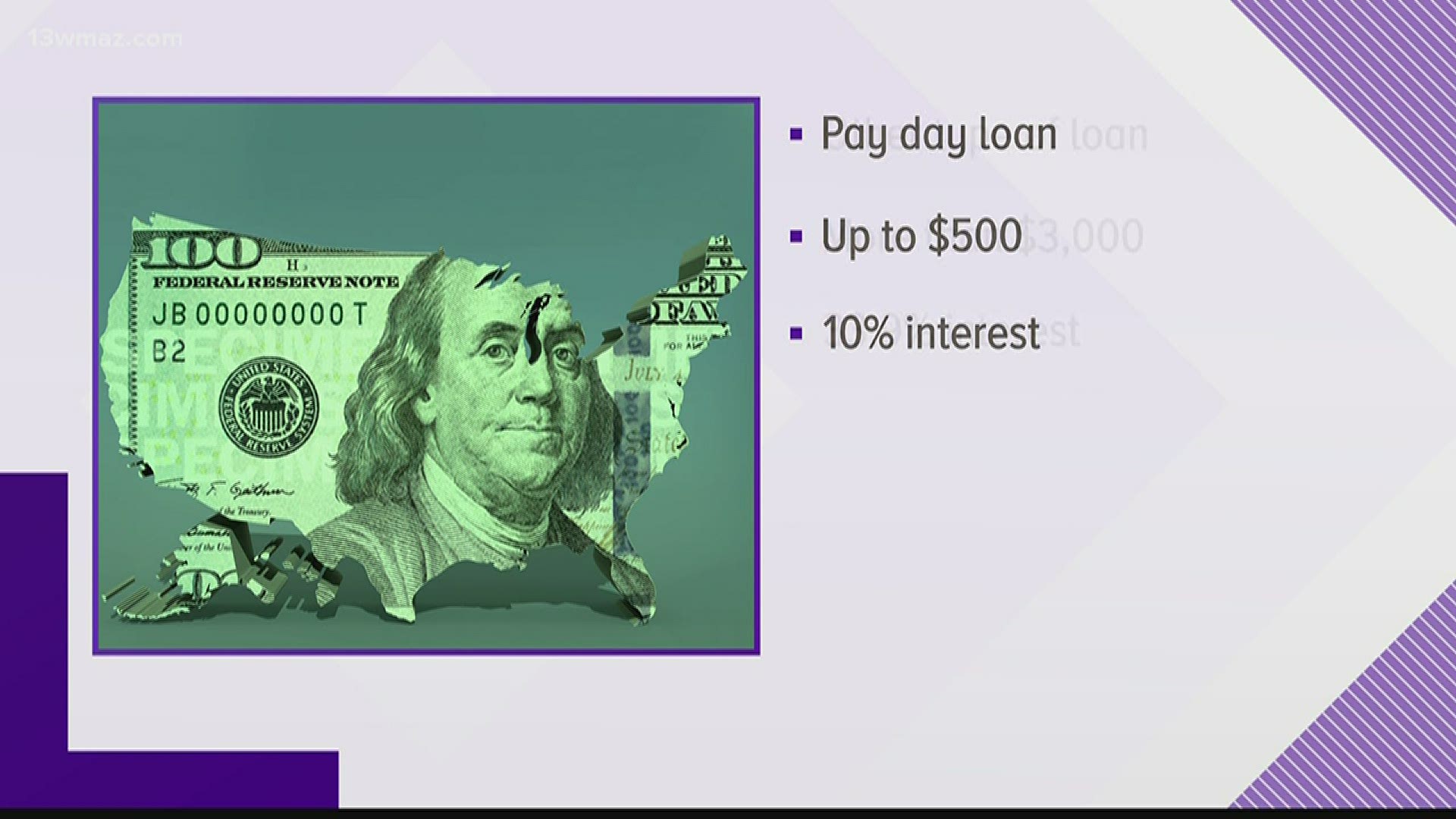

There are two popular types of loans that offer quick cash. A payday loan is a short-term loan of up to $500. They're marketed as a short-term cash advance until your next paycheck.

In Georgia, the law says you'll pay10 percent. It's not cheap, but you could pay a lot more if you go online. There are other loans of more than $3,000 . By law in Georgia, you can be charged no more than 33.9 percent interest. Other states can charge you a lot more.

Goss has this advice, "If they have bad credit and they can't go to a bank or a credit union, they need to contact finance companies here in the state of Georgia."

STAY ALERT | Download our FREE app now to receive breaking news and weather alerts. You can find the app on the Apple Store and Google Play.

STAY UPDATED | Click here to subscribe to our Midday Minute newsletter and receive the latest headlines and information in your inbox every day.

Have a news tip? Email news@13wmaz.com, or visit our Facebook page.