MACON, Ga. — Opening this year’s tax assessment notice could be a shock for some Macon-Bibb County property owners, but the estimated tax amount might not reflect how much you will actually have to pay later this year.

Tax notices are in the mail, but contain only an estimate of what would be due under the current millage rate of 19.901. The notices also show the current fair market assessed value, which is the basis for what property owners will ultimately pay.

Tuesday evening as Mayor Lester Miller unveiled his proposed $198.2 million budget, he mentioned that calls and comments are already coming in about the assessments. He explained that City Hall is not the best place to call to complain.

“Those tax assessment notices are estimates generated by the tax assessor’s office and it has nothing to do with myself or these commissioners. Have no input whatsoever,” Miller said.

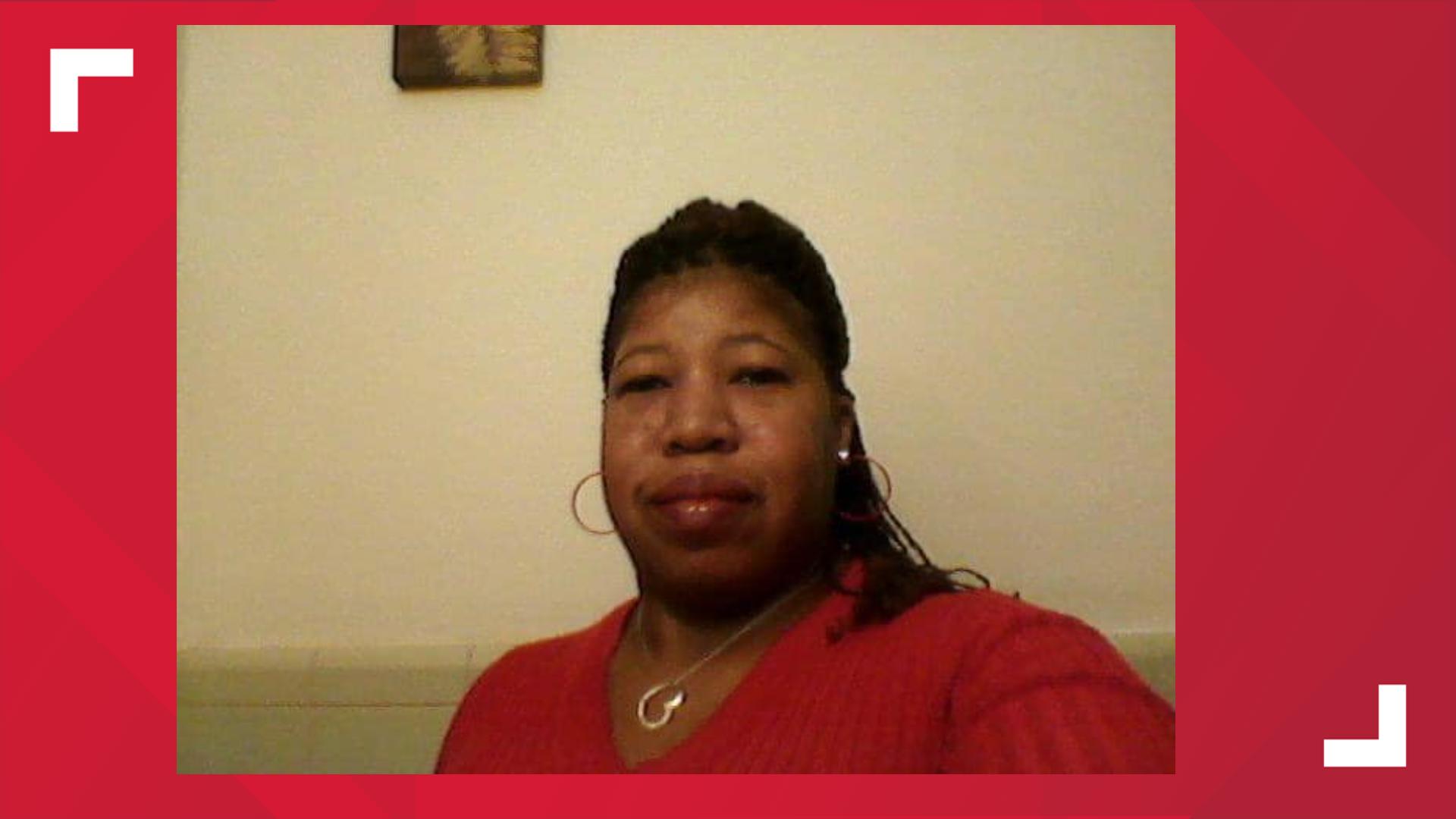

Chief Appraiser Andrea Crutchfield, who was meeting with her state colleagues out of town Wednesday, said by telephone that her office’s role often is misunderstood.

“I think a lot of people think we do this just to raise taxes,” Crutchfield said. “We don’t really have anything to do with the taxes. We’re just required by law to assign a fair and equitable value to each property. Millage rates are set by the county commission and board of education.”

Because of the increase in property values in the recent real estate boom, Miller and commissioners will likely roll back the tax rate. How much of a rollback will depend on the tax digest, which is the sum of the worth of all the taxed properties.

Properties are grouped into districts. Tax assessments for certain phases of a subdivision could be treated differently, so values may increase or decrease at different levels in the same neighborhood.

“Lake Wildwood is all one subdivision but there are waterfront properties and that makes a difference in the sales,” Crutchfield said.

Homes along the shore are generally worth more per square foot.

Of this year’s 66,000 notices coming out of the Macon-Bibb County Tax Assessors office, 40,000 parcels have been adjusted upward, Crutchfield said.

Values increased at an average of about 10 percent over last year in the initial assessment, Crutchfield said.

“It’s the market. Most all of our adjustments this year have been market driven, which is the sales that have occurred,” she said. “We have more this year than in many, many years and much higher prices in many, many years.”

Macon-Bibb had nearly 4,000 property sales in tax year 2021, she said.

The department of audits studies the increasing sales prices and the tax assessors office adjusts the values of similar homes in the neighborhood depending on their condition.

Both Miller and Crutchfield say other counties in Georgia are seeing the same trend.

“The mayors I spoke with, they all have had substantial increases in their tax assessments. And the reason is, I think it’s very obvious. … Properties are selling for a lot more. When you put an offer on a property now, you can’t just offer what they’re asking for. You have to offer more money,” Miller said in the budget presentation.

How to file an appeal

The amount of the tax digest won’t be known until taxpayers have had the opportunity to appeal the assessed values over a 45-day period ending June 27.

Appeal forms are available online at the tax assessors’ website and must be filed in writing either in person at 653 Second St. or mailed with a postmark of June 27 or earlier to be considered.

Once appeals have concluded and the assessments are finalized, Miller said the market-driven increased value of properties that were not physically improved or sold will be grouped in one category. The county will use the total of those increases to calculate how much to reduce the millage rate.

“As a county, we’re not taking in one more dollar on those tax assessments that went up except for new building and sales,” Miller said Friday.

Without a rollback, it would be considered a tax increase on those property owners with market-driven higher assessments. A public hearing would be required if Macon-Bibb wanted to keep those gains.

While Miller expects a rollback, the Bibb County School System functions independently and sets its own millage rate for local taxpayers based on the same digest.

The mayor also wants property owners to understand that if the millage rate is rolled back to compensate for the increased values that doesn’t mean no one will pay more in taxes this year.

Tax assessments go up or down at different rates depending on the condition of the property and its location.

“If you’ve got a 50 percent increase in your assessment, the rollback won’t help you as much,” Miller said. “There’s nothing you can do about it. People shouldn’t have spent that much on properties.”

Macon-Bibb County is better positioned to lower the millage rate substantially next year due to last year’s passage of the OLOST, or Other Local Option Sales Tax. Beginning this year, the county has collected an extra penny on every dollar. That revenue is funding public safety improvements and will provide property tax relief.

Next year, Miller anticipates lowering the millage rate by 35 to 40 percent.

Civic Journalism Senior Fellow Liz Fabian covers Macon-Bibb County government entities and can be reached at fabian_lj@mercer.edu of 478-301-2976.