HOUSTON COUNTY, Ga. — People who live or own a business in Houston County should be on the lookout for a new tax bill. Many will probably see a slight increase.

Even though Houston County Commissioners voted to lower their millage rate, property taxes will still go up.

Tuesday night, the county voted to set their 2023 millage rate back by .249 mills.

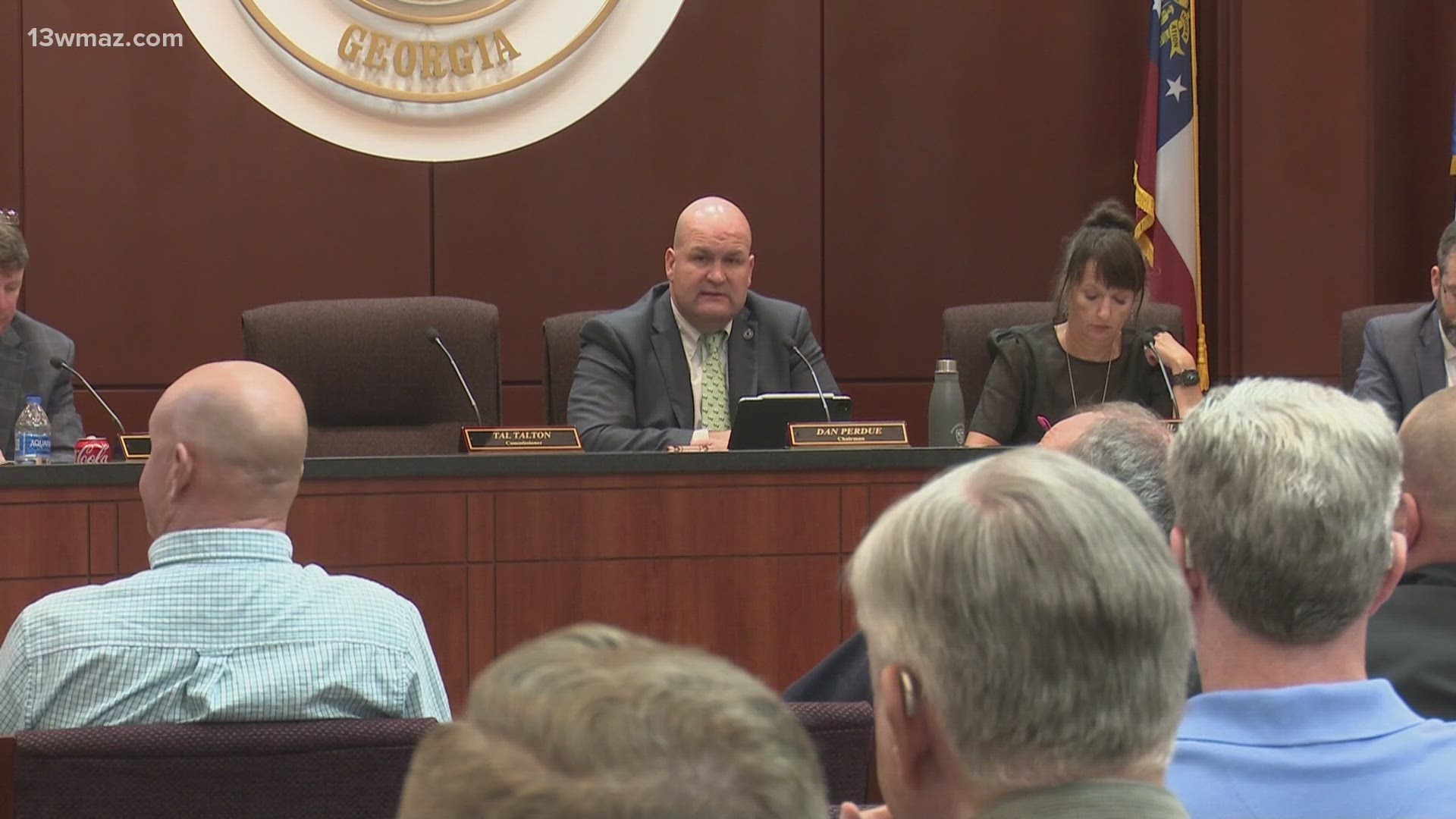

"Due to property values in Houston County going up significantly in the past year, we had to advertise that rate as a tax increase despite the fact that we actually reduced the millage rate," Chairman Dan Perdue said.

The 2023 millage rate is the lowest rate the county has seen in years. The county receives 80% of their general fund revenue from taxes, so they tried to keep a balanced budget.

"They came out to a good compromise," Houston County resident Norman Woodward said.

Woodward has lived in the county for 40 years, but he recently bought new property.

"They did a lot for people, particularly those who have seen their evaluations go up," Woodward said.

The county weighed several options like doing a complete rollback to 9.066, keeping it at 9.8100, increasing their tax cap, and more.

"I thought they considered all the points," Woodward said. "If they raised the rates, they won't be able to again, if they have to in the future. If they lower it too much, they may not be able to continue certain programs."

Over 40% of this money goes to public safety. Perdue says that they want to properly support their sheriff's department, court system and other public works projects.

He shared that if they rolled the rate back too far, that would hinder the county's public safety offices.

"Considering we are taking the Bonaire fire station full time, and we've hired nine new firefighters to staff that fire station, a revenue shortfall within our fire fund would be a significant setback," Perdue said.

Perdue says a home valued at $350,000 would see an increase in property tax just under $70.

"I feel like this strikes a balance between guaranteeing that we have the revenue to appropriately deliver services to the citizens of this county while attempting to offer some type of property tax relief," Perdue said during the meeting.

The county says tax bills will be mailed out in September to be paid this December. The new tax levy will be used to calculate the new bills.

For people that live in the incorporated parts of the county, that rate is 22.744 mills. Folks who live in the unincorporated parts will be 23.921 mills.