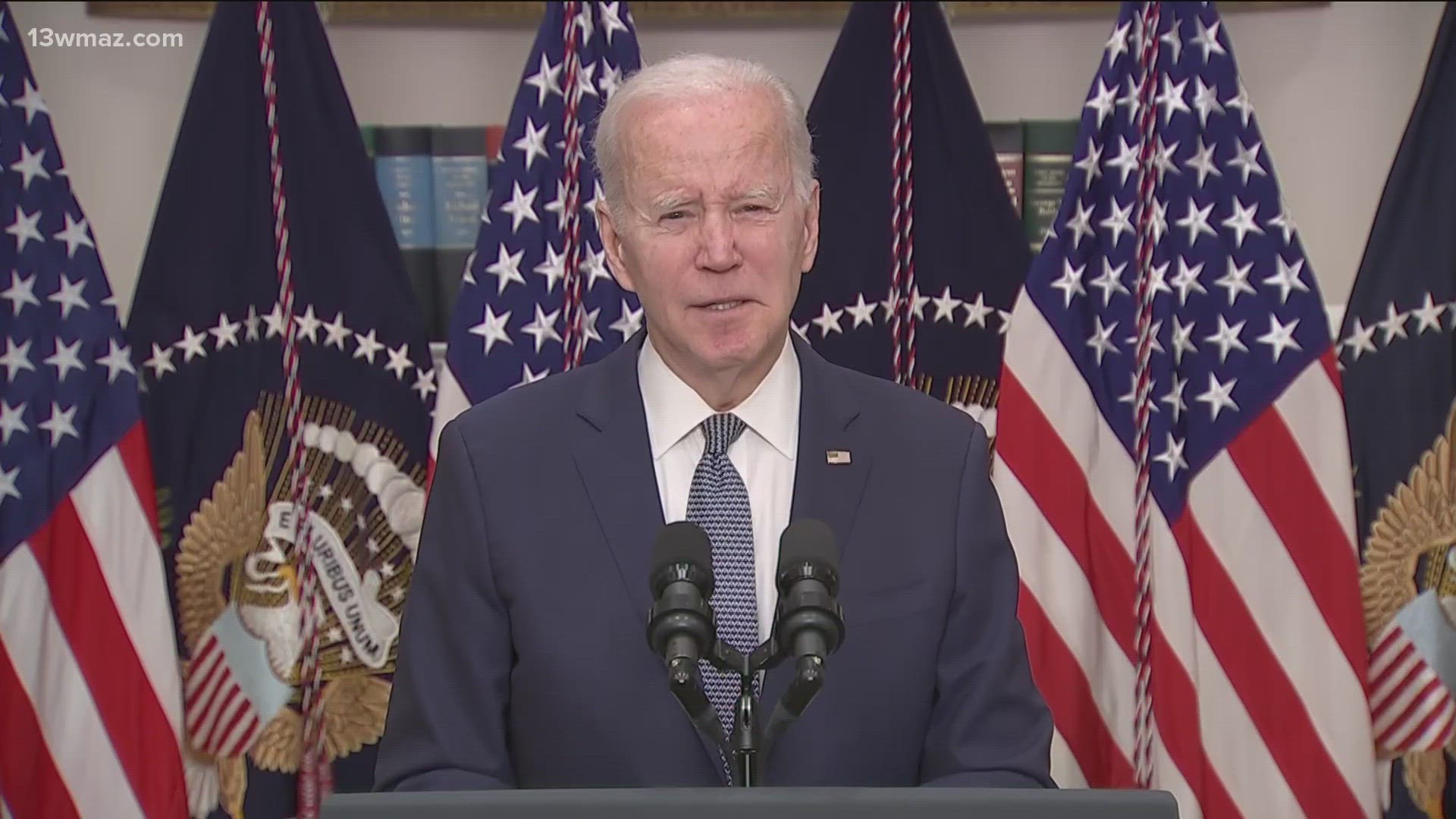

MACON, Ga. — Georgians are taking an increased interest in the state budgeting plans after two large California banks failed. President Biden on Monday told Americans that the nation's banking system is safe and their deposits are secure.

With issues surrounding those banks, many people are concerned about what it means for their own financial situation. To answer some of those questions Caleesha Moore sat down with Middle Georgia State University economist Greg George.

“How would you best explain what's happening to the average person,” 13WMAZ Reporter Caleesha Moore asked.

“One bank in particular, SVB, Silicon Valley bank in California ran into some financial problems. They had been losing money in the previous quarter and they needed to raise money really quickly so in order to raise money they went to sell a bunch of the U.S. treasuries that they own, which because interest rates are going up, the value of those treasuries have been coming down so they have not been able to raise enough money from selling some of their assets to cover all of their needs as a bank," Georgia said.

"They asked for investors to do a capital fund raising and everybody said ‘No, we don't trust that you're going to take care of our money’ and so they became quickly insolvent,” he said detailing the failure.

"Is this a signal of things to come by chance,” Moore asked.

“Remember during covid we had to create a lot of money to finance the shutdown, that created inflation, which became a problem up to 9.5% inflation last year, still at 6.4%,” George said. “We have high inflation, so the federal reserve bank has been initiating over the past 5-6 months, really the past year, a series of interest rate increases and the goal there is to slow down the economy and get the inflation under control."

"As a practical matter, people need to understand that their money is never really in the bank. Banks take in your deposits and then lend it out, so the money’s not there. If everybody goes to get their money tomorrow, it will not be there, that's true every day, not just today. So, there's no real reason for a panic today more so than a reason for panic three years ago," he said.

George says the FDIC insures any deposit under $250,000.

Its only "high wealth individuals," that may have more than $250,000 in their checking account, that risk losing some of that money if a bank fails.