MACON, Ga. — Your kids may have received some money for Christmas. Instead of buying video games or toys, why not invest it?

Financial advisor Sherri Goss says that’s a great way to make a gift keep giving.

“It’s possible it could create a lifelong habit of saving money, which would be phenomenal,” said Goss.

She has some tips for parents and family members interested in helping their child invest that money.

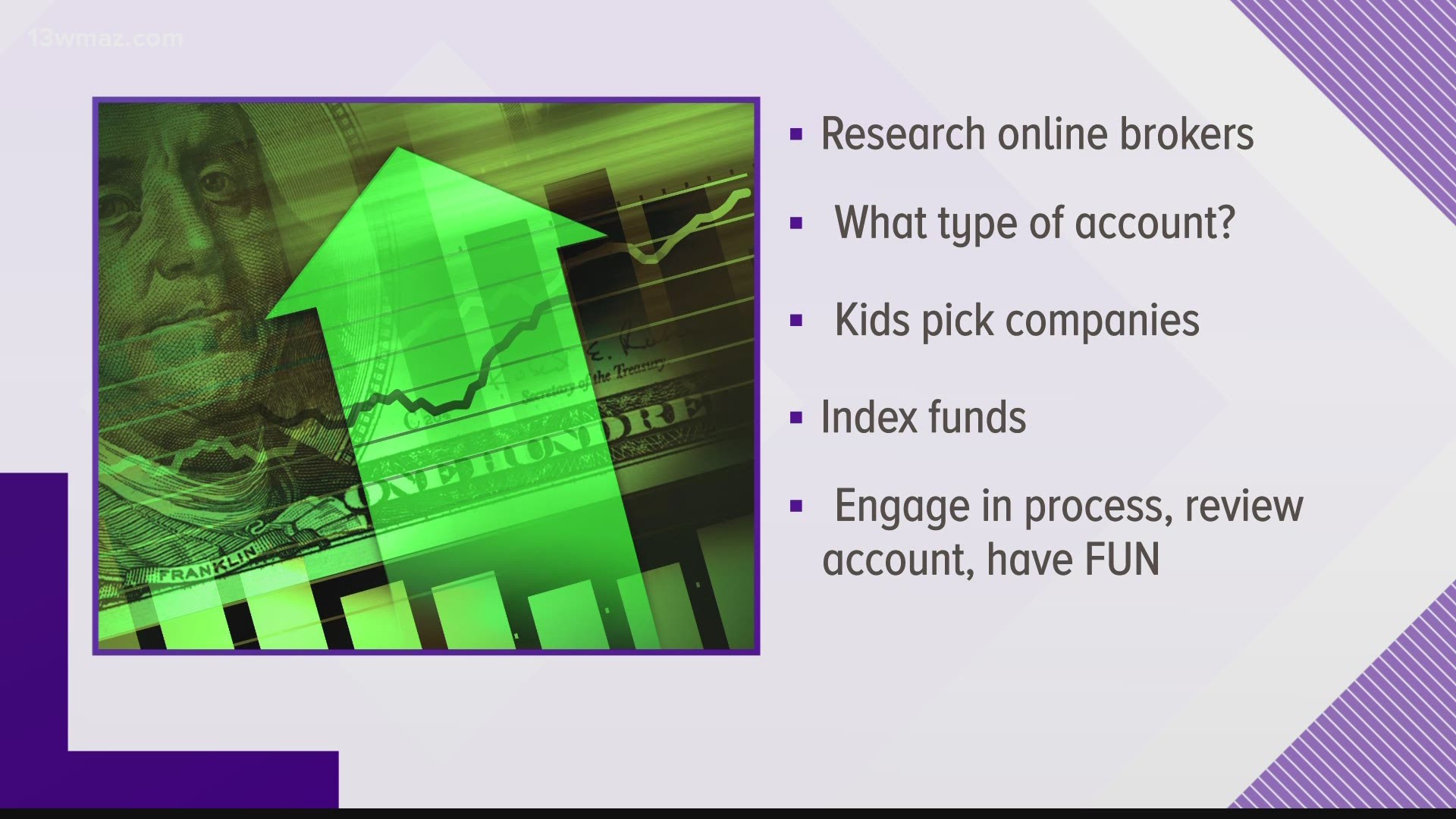

First, she recommends researching online brokers.

“You should choose one that doesn’t charge account fees and has no minimum initial deposit,” said Goss. “If you want to buy individual stocks, make sure the trades are low-cost or free.”

Next, you should figure out what type of account to open.

“If they work and receive a W2, they can contribute to a Roth IRA. If they don’t have income, open a custodial brokerage account online,” said Goss.

A parent will need to be the primary on the account until they turn 18.

She also suggests letting your kids pick companies they are interested in investing in and help them research the stocks.

“Understanding what a company does and why they own a share of their stock will keep them engaged,” said Goss.

If your child is not interested in stocks, Goss says to use index funds, which can be very inexpensive.

“The bottom line is to engage them in the process and review their account with them periodically,” she said.

Make it fun and you could create a great lifetime habit!

If you have a money question for Sherri Goss, you can text it to us at 478-752-1309

RELATED HEADLINES