Operations and finance committee chair Virgil Watkins say they're seeing about $10 million worth of savings in the 2019 budget year that just wrapped up.

"The return on our investment this year is solid. We had a surplus," said Watkins.

Macon-Bibb Mayor Robert Reichert warned against taking the bonus money from their general fund because of upcoming debt payments in the next three years.

"Our staff and our financial managers are busy preparing for some of those big things," said Watkins.

For the last few weeks, those advisers, the mayor, and other commissioners, voiced concerns about additional spending because of upcoming debt payments.

When the county consolidated, they had about $28 million in their general fund because of pension payouts and raises for the police and fire department.

Watkins says they're down to about $10 million.

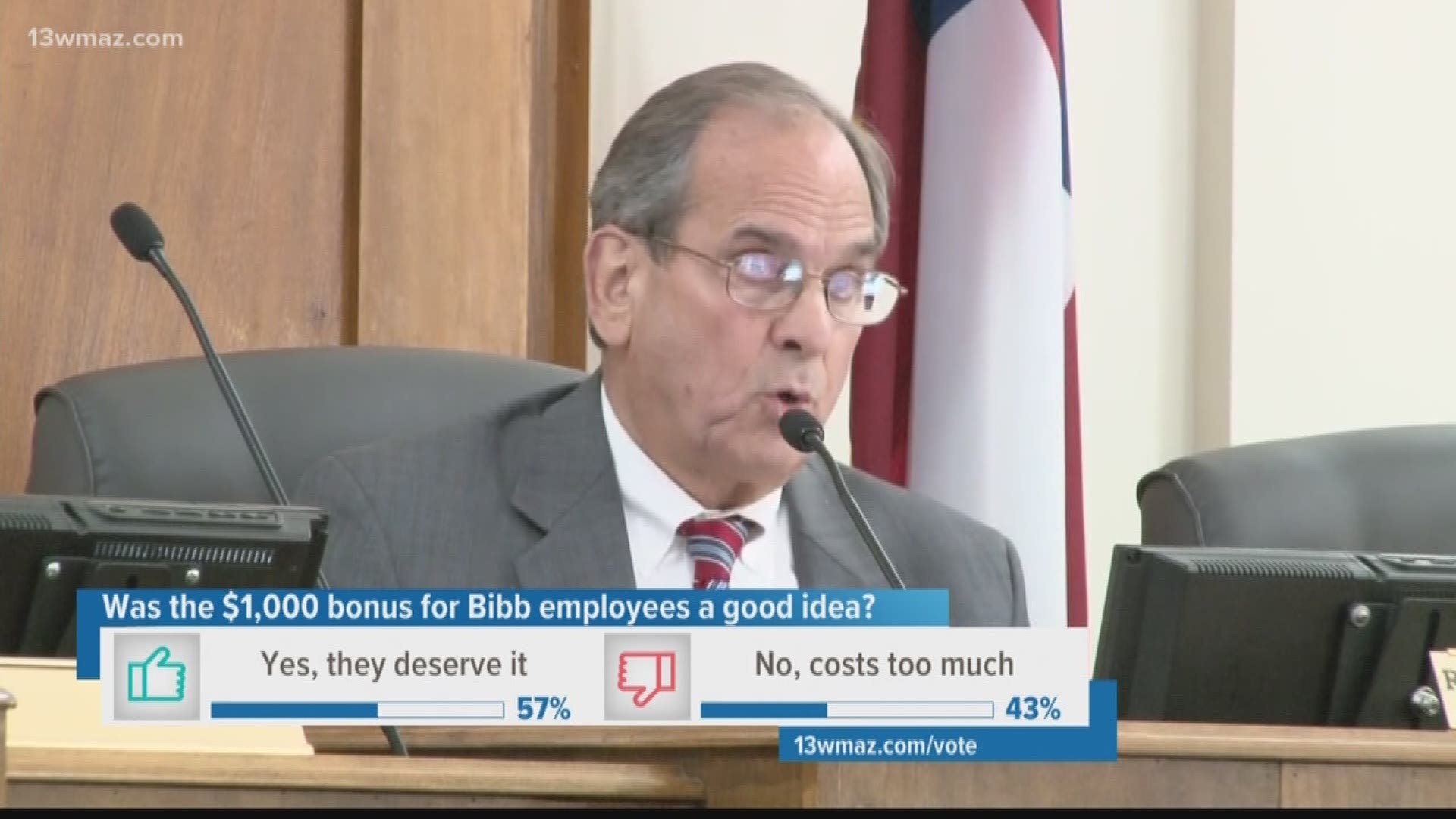

You can expect another $5 million to be put back into the reserves in 2020, but commissioners just approved of taking $2.3 million from that fund to dip to pay for a one-time bonus for county employees.

By the end of 2022, they'll have pension and debt payouts worth an estimated $9 million. If they dip too far into that fund, it could affect their bond rating.

"Returning a dividend is not a primary goal, it is to provide for our citizens and it may cost more money than some years when we have fluctuations," said Watkins.

Watkins says the county only estimates revenue -- they could see spikes and drops heading in either direction. He says the county needs to make its employees a priority, and he feels they are in a good position to deal with upcoming debt payments.

Tuesday, county spokesperson Chris Floore said they expected to hear from bond companies if the commissioners approved spending $2.3 million for employee bonuses. Wednesday, he said they're looking at ways to finance the changes so it doesn't hurt the county's credit.

A lower bond rating would mean the county would pay more in interest for those bonds. About a year ago, Bibb County's bond rating was downgraded by Moody's, the credit agency company. They cited problems with repeated deficits, low reserves, and poor socioeconomic numbers for their action.