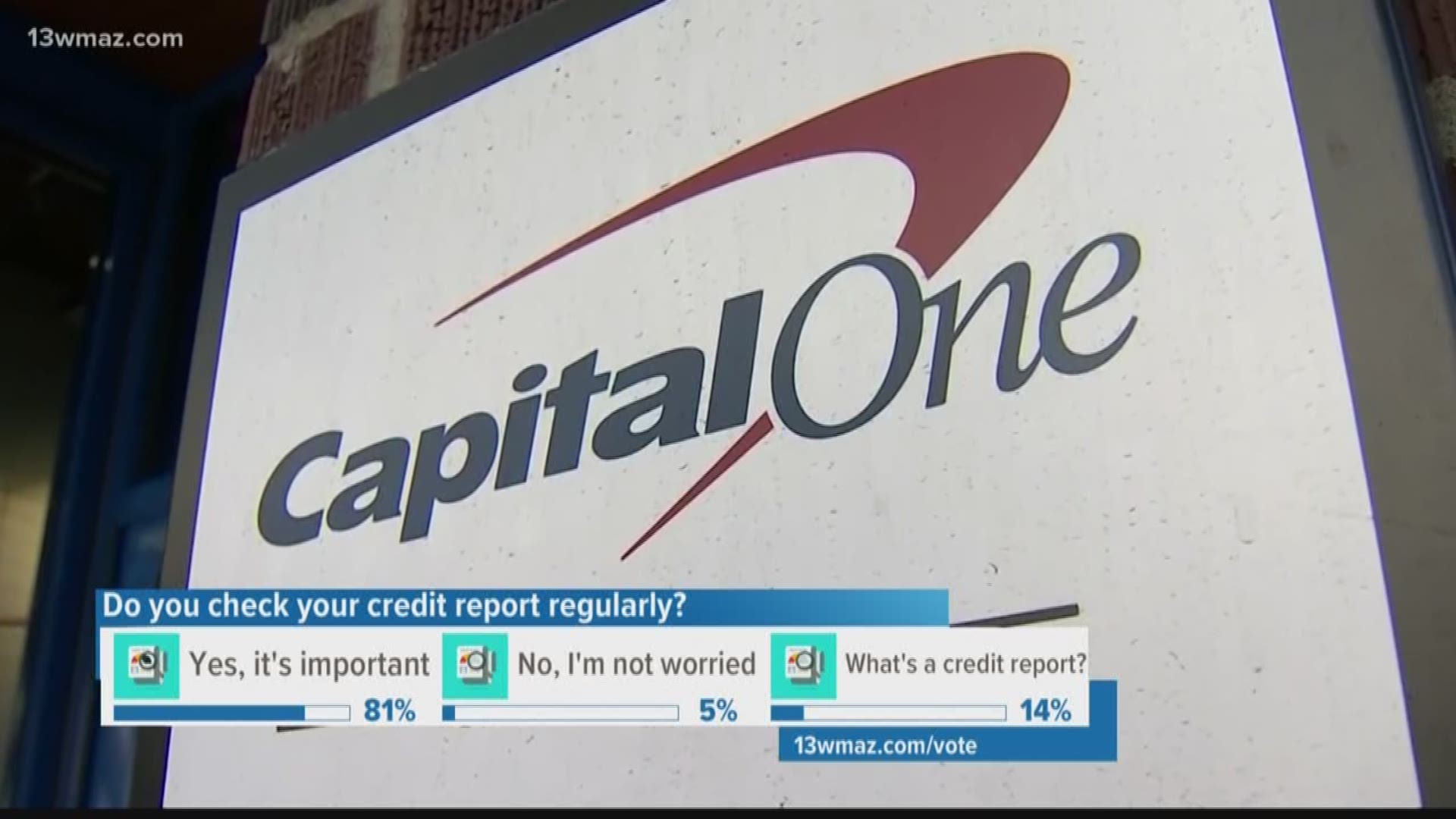

WARNER ROBINS, Ga. — Days after a massive Capital One data breach, people in Warner Robins were paying attention.

"Data breaches can be very serious," said Laurie Beebe.

Priscilla Ross agreed.

"It's scary because you don't know if your information [has] been compromised and if it's going to come out to be a really big financial problem for you," she said.

Jason Blankenship with the Better Business Bureau says that concern is well placed.

"It happens every two-and-a-half seconds, another person's identity is stolen," he said.

That's not to say every victim of the Capital One breach will have theirs stolen. The company says it's unlikely the exposed data was used for fraud.

However, Blankenship says this massive breach is just one more brick in the wall of risk people in the digital age face.

"It's not a matter of 'if,'" said Blankenship. "It's a matter of when," but he says there are ways to limit your risk, like frequently monitoring your credit reports and watching your credit card statements closely.

He also strongly recommends freezing your credit. It's a security method designed to stop people from opening new lines of credit without your permission.

"I implemented this years ago for my family," said Blankenship. "It's like buying a roast on sale and you don't want to cook it right now so you put it in the freezer. Well, when you want it you thaw it out, you cook it, and then you can refreeze it."

Laurie Beebe says that's what she does and it's saved her a lot of trouble.

"I'll take a special password and some additional paperwork if you want to open an additional credit account, but it's really worth going ahead and securing and protecting your personal identification data," she said.

If you want to do the same, Blankenship says it's a pretty straightforward process: contact each of the three major credit bureaus and tell them you want a freeze placed on your credit.

He says it won't affect your credit score, but it will make it much harder for someone to open a new line of credit in your name.

According to Blankenship, once you freeze your credit you'll be given a PIN number to unfreeze it when you want to open a new line of credit (like if you want a home or car loan) and then refreeze it. Without the PIN number, he says it's very difficult for someone to open a new line of credit.

The contact information for each credit bureau (plus Central Georgia's Better Business Bureau branch) is below.

Equifax: 800-685-1111 (www.equifax.com)

Experian: 888-397-3742 (www.experian.com)

TransUnion: 800-888-4213 (www.transunion.com)

Macon Better Business Bureau branch: 478-742-7999