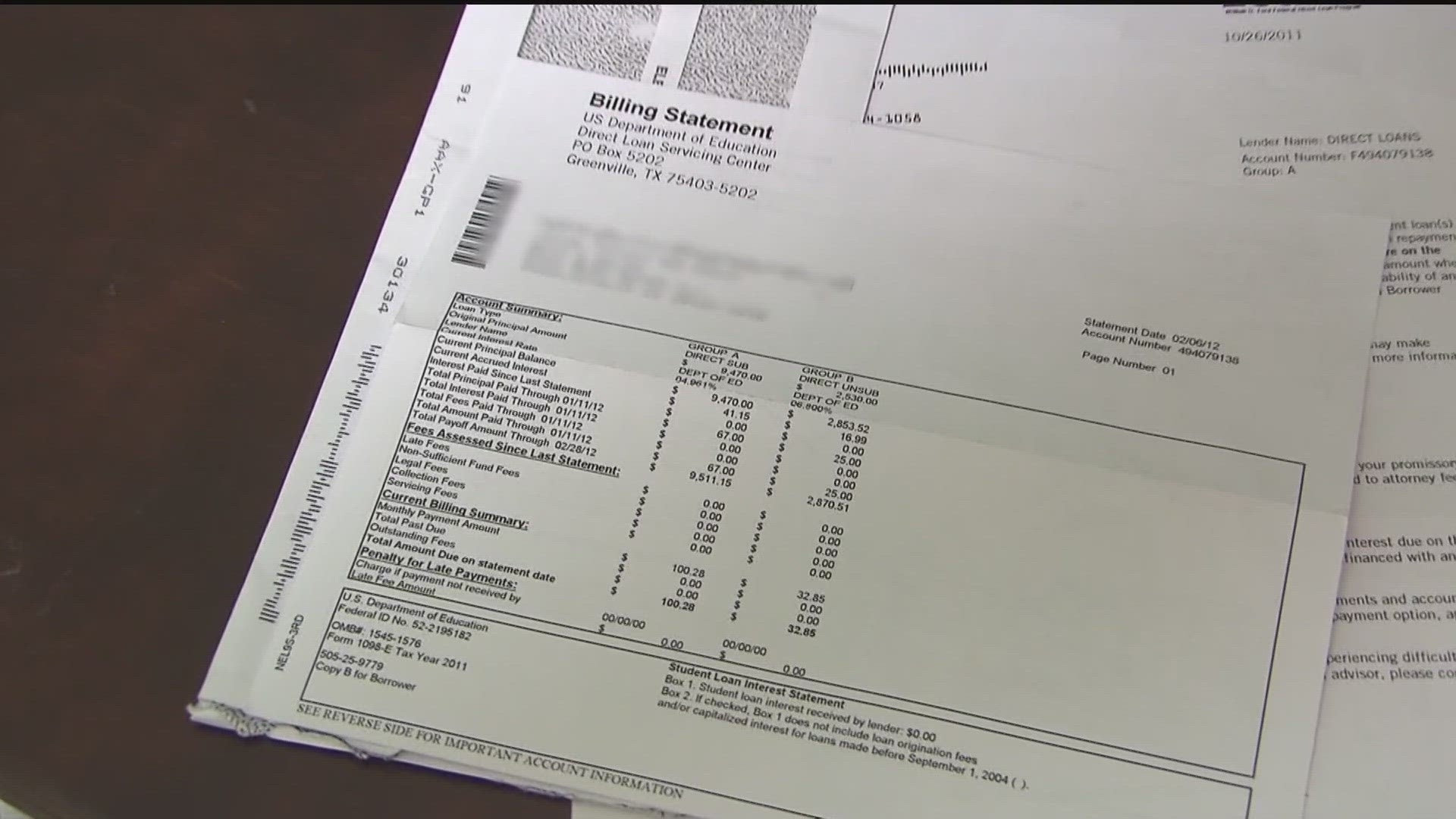

ATLANTA — The same day student loan borrowers are scheduled to make their first payment, the government could be shutting down.

Here's how that could affect payments.

For the most part, loan servicers will be able to continue to process payments regularly — but there could be delays for those who need to consult with or seek help from the Education Department due to the potential of agency furloughs.

"There’s going to be 45 million people that are going to have to start making payments again," said Ted Jenkin with oXYGen Financial. "And certainly, if the government shuts down for an extended period of time, I would say more than 30 days, there could be hiccups in the payment processing part of it because nobody’s going to be working at the government. But otherwise, people are responsible for their payments. They haven’t made payments in three and a half years, and it’s going to start to pick up again."

Interest began accruing on Sept. 1 following the pandemic pause placed on student loans, and the return of payments will be in just a couple days - on Oct. 1.

And that Oct. 1 payment re-start will take effect whether the government is operating or not.

RELATED: What would a government shutdown mean for me? SNAP, student loans and travel impacts, explained

As for the government's student loan resources, during a Sept. 25 press briefing, White House press secretary Karine Jean-Pierre told reporters that “key activities at Federal Student Aid will continue for a couple of weeks” in the event of a government shutdown.

“The Department of Education will do its best to support borrowers as they return to repayment,” Jean-Pierre said.

Jenkin said the first thing people should do is find their Federal Student Aid IDs and go to StudentAid.Gov or go to the National Student Loan Data System to find out where your loan lands.

"That’s an easy way to do it because what you want to find out now are what are my payments, haven’t been making them for three and a half years and how much am I going to owe on a monthly basis," said Jenkin.

Jenkin offered some advice for what people should be looking at right now, ahead of payments restarting.

"Of course, sharpening your pencil and re-going through the budget and figuring out what you don’t need is going to be important," said Jenkin, adding people should try to cut out any unnecessary subscriptions.

Jenkin suggested people figure out how much income they need to make over the next year, especially as he said credit card debt and auto loan debt are both rising.

"I think the biggest thing is you need to look at the income-driven repayment plans," said Jenkin. "The government came out with something now called the SAVE Plan, saving on a valuable education, and what that allows you to do is pay up to 5% of your discretionary income, the old rules were at 10% of your discretionary income so you just pay less."

Jenkin added he knows people are worried about if they can't make payments.

"Well the government is instituting something now called the on-ramp program," said Jenkin. "Essentially, you would normally default in 270 days, but with the on-ramp program, you’re not going to have bill collectors after you, nobody’s going to garnish your wages, and you really have sort of a 12-month window."

Students applying for federal aid during a shutdown can expect similar delays because of this. Officials have pointed to potential disruptions to processing FAFSA applications, disbursing Pell Grants and pursuing public loan forgiveness, for example.

News happens fast. Download our 11Alive News app for all the latest breaking updates, and sign up for our Speed Feed newsletter to get a rundown of the latest headlines across north Georgia.