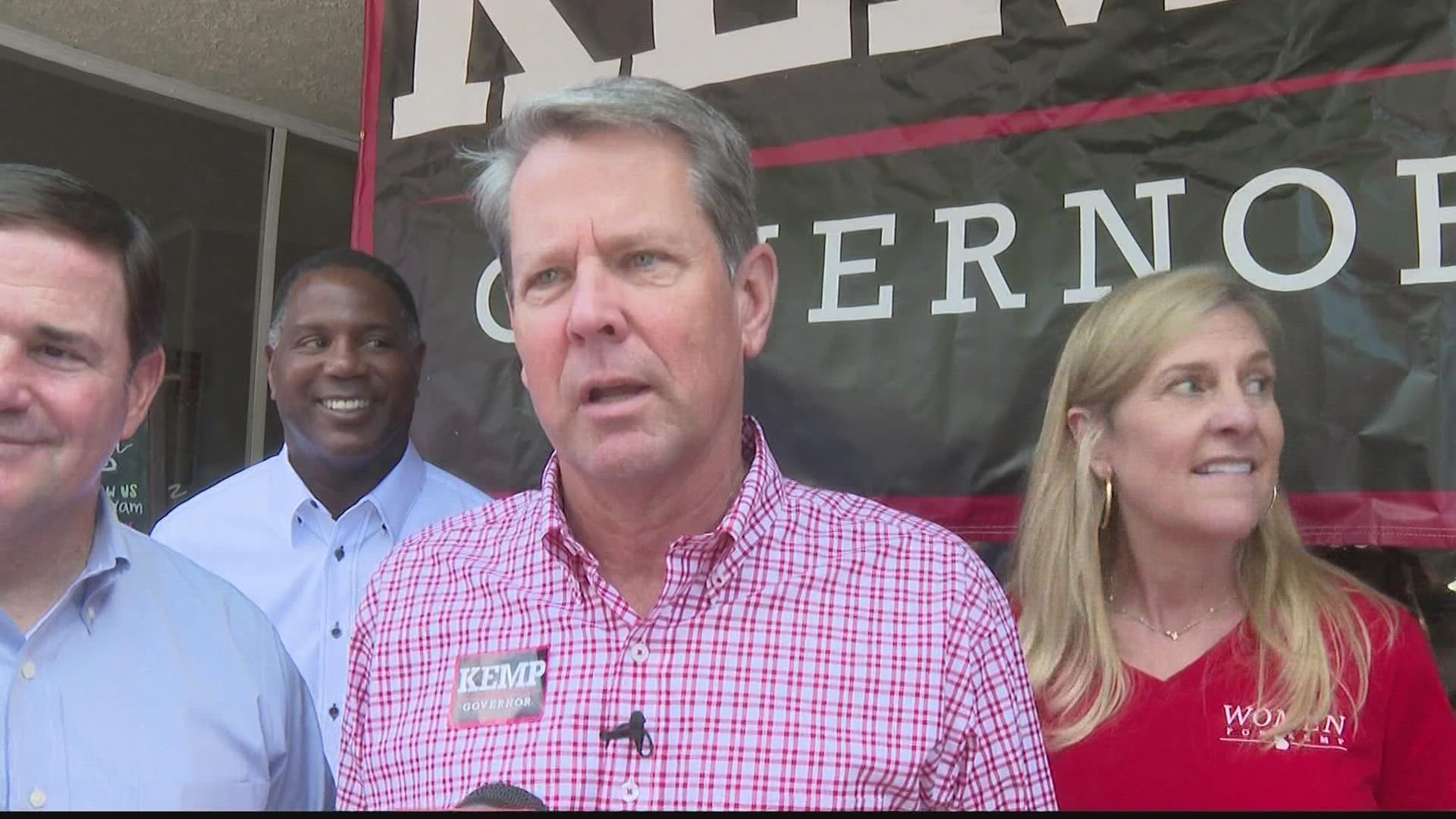

ATLANTA — Seeking to make a splash in his reelection bid against Stacey Abrams, Gov. Brian Kemp announced dueling proposals to use Georgia's budget surplus to provide a second round of tax refund checks and restore a property tax break that hasn't been activated by the state legislature since 2008.

The catch? To actually provide those measures, Kemp has to win in November. (Though, as far as the rebate checks go, Stacey Abrams has offered a mirror proposal - so those could be coming regardless of who wins.)

For a breakdown of some of the important things to understand about the proposal, read below:

Georgia tax refund checks Round 2 and property tax break proposal

- The tax refund checks would be the same as the ones they issued earlier this year: Both Kemp and Abrams have proposed copying the structure of the refund checks that Georgians received this year: $500 for married joint filers, $375 for single filers with dependents, and $250 for single filers.

- They wouldn't come until next year: Either Kemp or Abrams would need the checks to be approved first by the state legislature, the Georgia General Assembly. The legislature doesn't return to session until January - meaning even if they came to session and approved it immediately, you probably wouldn't see any money until mid-winter or spring 2023 at the earliest.

- The exact eligibility is undetermined: The checks earlier this year were only for people who paid Georgia state income taxes in 2020 and 2021. Whether the next round would only be extended to those who had Georgia tax returns in 2021 and 2022, or whether that qualification would be modified in some way, would be up to the legislature (and, obviously, they haven't done anything on this yet).

- The property tax break is already part of Georgia law, but inactive: A handout from the governor's office noted it was established in 1999 under O.C.G.A 36-89-3 and 36-89-4. Basically, it gives the state legislature the option to provide for a property tax break - they just haven't done it since 2008.

- It would provide for about a $500 savings to homeowners on average: The specific amount would vary. The governor's office said it would be about 15-25% on property tax bills.

- You most likely wouldn't see that until 2024, however: The tax break would, as with the refund checks, need to be approved by the legislature when they meet again in Jan. 2023. If they were to approve it, it would only likely apply to 2023 property taxes - which you wouldn't file for, and see the savings on, until 2024.

- Abrams opposes the property tax break: Unlike with the refund checks - in which either winner of the 2022 governor's race has endorsed using some of the surplus for direct cash payments - Abrams sees the property tax break as "paying off the property taxes of mansion owners and millionaires."