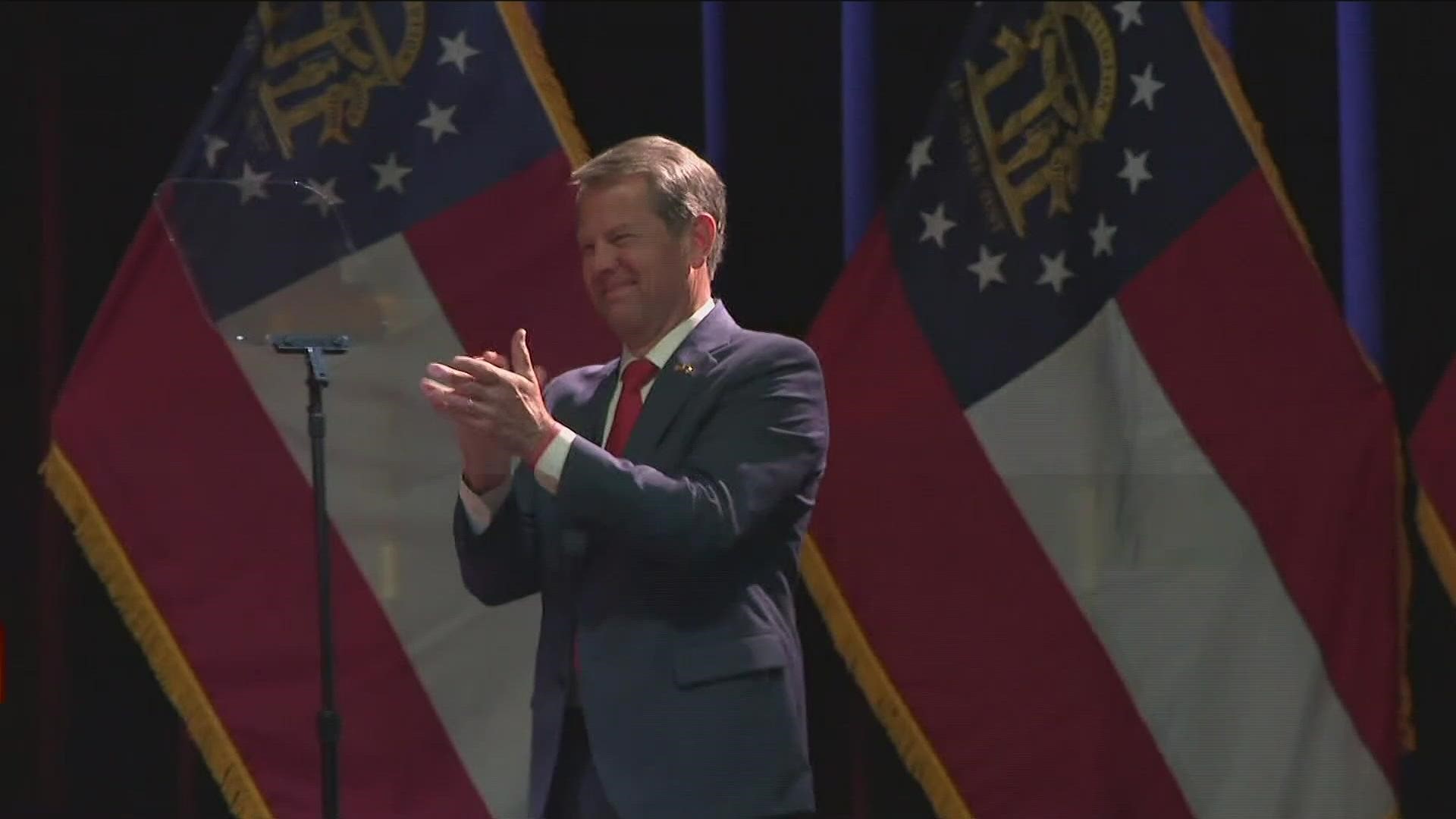

ATLANTA — Georgians are one step closer to having a little extra money in their pocket, according to a tweet from Gov. Brian Kemp.

On Thursday, the Georgia House passed the state income tax refund proposal, H.B. 162, which means another round of the $250-$500 payments given out last year.

Kemp proposed this refund earlier in the year, following up on a promise he made on the campaign trail.

The $1 billion income tax refund proposal comes out of the state's budget surplus. It provided for a three-tiered structure of refund payments:

- $500 for married couples filing jointly

- $375 for single filers with dependents

- $250 for single filers

The payments will only go to people who paid Georgia state income tax in both 2021 and 2022.

One change with this year's bill is that people who paid state income tax but are claimed as a dependent - such as a high school student who works a job - can qualify for the $250 payment.

The proposal still needs to pass in the Georgia Senate and then be signed by Gov. Kemp to take effect.

Georgia previously issued tax refund checks, drawing from the state surplus, last year.

That $1.6 billion measure drew out of a $2.2 billion surplus, and provided for $250-$500 payments to state taxpayers. According to the Associated Press, Georgia ran a surplus of about $5 billion for the 2021-22 fiscal year that concluded at the end of June.

Fearing revenue would tank amid the COVID pandemic, Georgia lawmakers cut 10% from the spending plan while developing the budget for the 2021 fiscal year in the summer of 2020. Once it became clear revenue wouldn't plummet, the state government then restored hundreds of millions of dollars back into its education budget.

However, other agencies across the Peach State have continued along with reduced funding, in part creating the surplus.